FEATURED POSTS

Bob Books travel photo book review and 2024 giveaway

Principe day trip – journey to the edge of the world

Cordoba Patios Festival 2024 – the Ultimate Guide to Visiting

West Highland Peninsulas: Ultimate Guide to Scotland’s Secret Coast

Chinchero to Urquillos Hike – Peru’s other Inca Trail

Gede Ruins – exploring an ancient Swahili village

QUIRKY LUXURY BY NIGHT

Stanbrook Abbey Hotel Review

Hot tub holidays in Cornwall at Wrinklers Wood Treehouse

Staying in the Chevalier’s Gatehouse at Upton Cressett – a Review

Review of Omali Lodge – a Boutique Hotel on Sao Tome

Review of Sundy Praia Luxury Beach Lodge on Principe

East Gatehouse Lodge, Crieff – a Luxury Scotland Staycation

ADVENTURE BY DAY

Principe day trip – journey to the edge of the world

Cordoba Patios Festival 2024 – the Ultimate Guide to Visiting

West Highland Peninsulas: Ultimate Guide to Scotland’s Secret Coast

Rannerdale Bluebells 2024 – parking, walks and more

Chinchero to Urquillos Hike – Peru’s other Inca Trail

São Tomé day trip – southern beaches & plantations

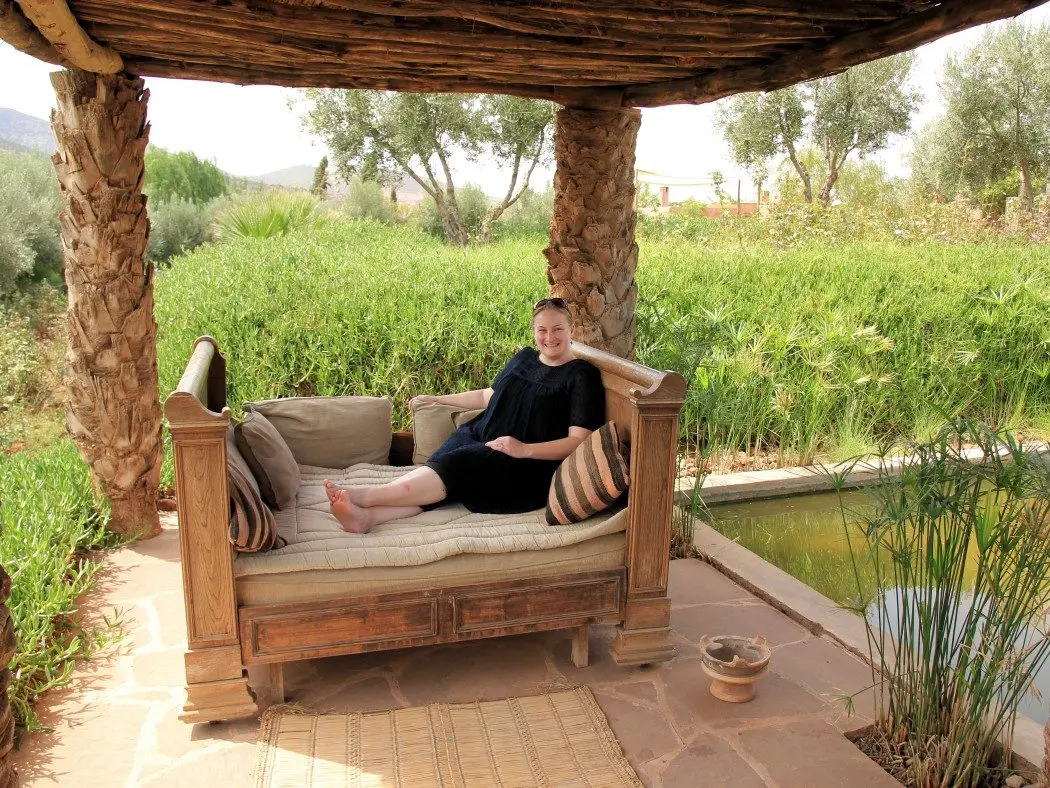

MOROCCO EXPERTS

Books about Morocco – 17 best novels set in Morocco

Luxury Marrakech & Atlas Mountains Itinerary

Tipping in Morocco – how much to tip who, and when

What to wear in Morocco

Marrakech souks: Top Tips for Navigating Your Way Around

Top 10 Scams in Marrakech, and how to avoid them

WE’VE PARTNERED WITH